Headed to the Gulf Coast? Learn how travel insurance protects your beach trip from cancellations, weather, delays, and unexpected emergencies

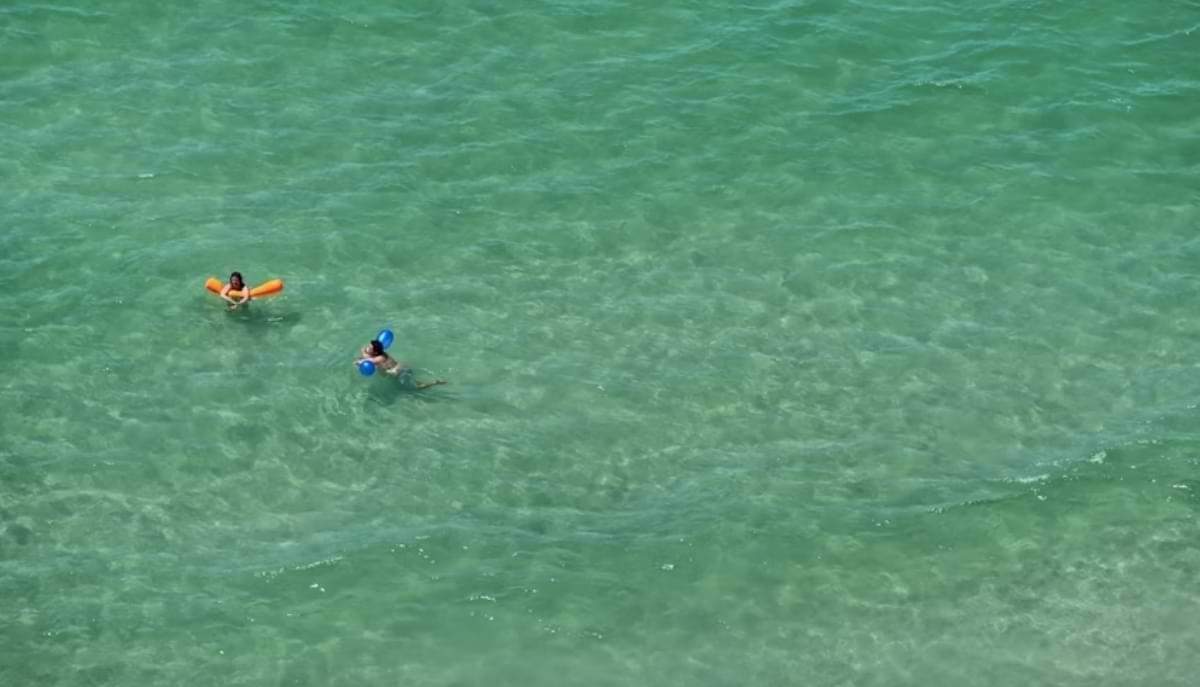

Planning a trip to the sun-kissed shores of Orange Beach, Gulf Shores, Fort Morgan, or Pensacola? You're likely dreaming of soft white sands, vibrant blue waters, and that unmistakable Gulf Coast charm. While your mind may be occupied with thoughts of beachside relaxation or the thrill of water sports, there's one essential aspect of your vacation you shouldn't overlook: travel insurance.

I get it, thinking about insurance isn't the most exciting part of planning a vacation. In fact, many travelers in the U.S. often skip over it, viewing it as an unnecessary expense. However, there's a strong case to be made for including travel insurance in your vacation plans, especially when heading to popular destinations like the Gulf Coast.

In this quick guide, I'll share all you need to know about travel insurance, plus some extra tips to ensure your vacation is as smooth and stress-free as possible.

At Luxury Coastal Vacations, we offer a wide range of rental options along the Gulf Coast, paired with exceptional customer service and meticulous attention to detail in every aspect of your vacation. As experts in Perdido Key, Pensacola, Orange Beach, and Gulf Shores, our destination blog covers everything from top pet-friendly spots and kid-friendly activities to must-try restaurants, local distilleries and breweries, and tips for the perfect beach day.

Ready? Travel insurance sounds dull, but trust me, this is where smart trips start. Let's dive in!

Understanding Travel Insurance

Travel insurance acts as a safety net, covering a wide range of unforeseen events that could disrupt your travel plans. From trip cancellations and delays to medical emergencies and lost luggage, travel insurance ensures that you are not left vulnerable when the unexpected occurs. We offer a Trip Preserver plan by Red Sky Insurance, which provides comprehensive coverage tailored specifically for vacation rental stays.

What is Travel Insurance?

At its core, travel insurance is a contract between you and the insurance provider, offering financial protection against specific risks associated with travel. These risks can range from minor inconveniences, such as delayed flights, to major disruptions like medical emergencies or natural disasters. By purchasing travel insurance, you transfer the financial risk of these events to the insurance company, allowing you to travel with confidence.

Types of Coverage

Travel insurance policies typically offer a variety of coverage options, including:

- Trip Cancellation and Interruption: Reimburses you for non-refundable expenses if you need to cancel or cut short your trip due to covered reasons.

- Medical and Emergency Assistance: Covers medical expenses incurred during your trip, including hospital stays and emergency evacuations.

- Travel Delays and Missed Connections: Provides compensation for additional expenses incurred due to travel delays or missed connections.

- Baggage Loss or Damage: Reimburses you for lost, stolen, or damaged luggage and personal belongings.

- Weather-Related Disruptions: Offers coverage for trip interruptions caused by natural disasters.

5 Key Benefits of Travel Insurance

To view full policy details and exclusions, please click here.

1. Trip Cancellation and Interruption Coverage

Life's unpredictability can sometimes disrupt even the best-laid plans. Trip cancellation and interruption coverage may provide some reimbursement for non-refundable expenses. This means that if unforeseen circumstances require you to cancel or shorten your trip, there could be a possibility of recovering your prepaid expenses. As with all insurance claims, documentation such as doctors' notes or receipts is required to support your claim.

2. Medical Emergencies

While we all hope for a safe and healthy vacation, medical emergencies can happen unexpectedly. Travel insurance provides coverage for medical expenses incurred during your trip, including hospital stays, doctor visits, and even emergency medical evacuations. This is especially important if your health insurance does not cover you while traveling out of state or internationally. Consider a scenario where you're exploring the beautiful beaches, and you suffer an injury that requires immediate medical attention. The cost of medical care can be significant. With travel insurance, you can rest assured that your medical expenses are covered with provided documentation allowing you to focus on recovery rather than worrying about bills.

3. Travel Delays and Missed Connections

Travel delays are not only inconvenient but can also be costly. If your flight is delayed or you miss a connection, travel insurance can cover additional expenses such as accommodation, meals, and transportation. This ensures that a delay doesn't derail your entire vacation experience.

4. Lost, Stolen, or Damaged Luggage

Losing your luggage or having it damaged can be a major setback, especially when you're far from home. Travel insurance can reimburse you for the value of your belongings, allowing you to replace essential items and continue enjoying your vacation without added stress.

5. Weather-Related Disruptions

Like many coastal destinations, the Gulf Coast can sometimes be influenced by weather conditions such as hurricanes. Travel insurance might offer some protection if your trip is affected by natural disasters or mandatory evacuations. Imagine planning a getaway and discovering that a hurricane might be approaching the coast. If you are required to evacuate or if your travel plans are disrupted, travel insurance may provide reimbursement for non-refundable expenses and additional costs that could arise due to the weather event.

How Does Travel Insurance Work?

When you purchase travel insurance, you're essentially buying a safety net for your trip. We partner with the best, Trip Preserver.

Here's how it works:

- Pay the Premium: You pay a one-time premium for the coverage, which is 7.95% of your total reservation costs and is not taxed.

- File a Claim: If an unexpected event occurs that's covered by your insurance — such as needing to cancel your trip due to illness, you would file a claim with Red Sky. You'll need to provide documentation, such as a doctor's note or receipts, to support your claim.

- Receive Reimbursement: If your claim is approved, the insurance company will reimburse you for the covered losses, up to the limits specified in your policy.

Extra benefits

Tailored for Vacation Rentals

Unlike standard travel insurance policies, Trip Preserver is tailored specifically for vacation rental guests. This means that the coverage is designed to address the unique needs and concerns of travelers staying in rental properties, providing an extra layer of protection and peace of mind.

Peace of Mind for Your Getaway

Investing in travel insurance is a smart decision that can enhance your vacation experience by eliminating worries about potential disruptions. With the right coverage, you can focus on enjoying the stunning sunsets, exploring the attractions, and creating unforgettable memories with your loved ones.

Enhancing Your Travel Experience

Travel insurance not only protects your financial investment but also enhances your overall travel experience. By alleviating concerns about potential mishaps, you can fully enjoy your vacation. Whether you are indulging in fresh seafood at local eateries or simply relaxing on the beach, travel insurance allows you to enjoy every moment without the burden of "what if" scenarios.

Extra Tips for a Safe and Fun Gulf Coast Vacation

The Gulf Coast, with its picturesque beaches and vibrant communities, is a beloved destination for many. With a little preparation, you can ensure your vacation is smooth and enjoyable. Here are some additional tips to help you make the most of your time in Orange Beach, Gulf Shores, Fort Morgan, and Pensacola:

- Book Early: The Gulf Coast is a popular destination, especially during peak seasons like summer and spring break. To secure the best accommodations, it's wise to book your stay early. Doing so not only gives you more options but often results in better rates.

- Practice Beach Safety: While enjoying the sun and surf, it's important to stay safe. Familiarize yourself with local guidelines, especially those related to rip currents and beach flag warnings. Simple precautions, like swimming in designated areas and staying hydrated, can help ensure a trouble-free vacation.

- Pack the Essentials: Don't forget to pack essential items like sunscreen, beach towels, and flip-flops. Consider bringing a cooler for drinks and snacks if you plan on spending long periods at the beach. Also, keep some cash handy for parking fees and tips for local vendors.

- Explore Beyond the Beach: While the beaches of Orange Beach, Gulf Shores, Fort Morgan, and Pensacola are the main draw, don't miss out on exploring the surrounding areas. Visit local attractions like the Alabama Gulf Coast Zoo, Fort Morgan Historic Site, or take a scenic drive along the coastal highways. Diversifying your activities ensures a more well-rounded vacation experience.

- Check Out Local Events and Festivals: The Gulf Coast is home to numerous events and festivals throughout the year. From seafood festivals to live music events, there's always something happening. Check the local event calendar before your trip to see if anything coincides with your stay.

FAQ: Travel Insurance for Your Gulf Coast Vacation

Do I really need travel insurance for a beach trip?

Yes. Even a short Gulf Coast getaway can face unexpected bumps like flight delays, medical needs, or bad weather. Travel insurance helps protect your plans and your wallet.

What does travel insurance usually cover?

Most policies cover trip cancellations, medical emergencies, weather disruptions, baggage issues, and delays. The Trip Preserver plan we recommend is designed with vacation rentals in mind.

How much does travel insurance cost?

With Trip Preserver, the premium is 7.95% of your total reservation cost. It's a one-time payment that covers you for the duration of your stay.

Does it cover hurricanes or bad weather?

Yes. If a storm or mandatory evacuation disrupts your plans, you may be reimbursed for non-refundable costs and additional expenses.

What happens if I need to file a claim?

You submit documentation, like receipts or a doctor's note, to the insurance company. If the claim is approved, you'll be reimbursed up to the policy limits.

Does my health insurance cover me while I'm traveling?

Not always. Many U.S. health plans have limited or no coverage out of state. Travel insurance ensures you're protected for emergencies, including hospital visits or medical evacuations.

What makes Trip Preserver different from regular travel insurance?

It's built specifically for vacation rentals, covering situations unique to rental stays, giving you extra peace of mind when booking with Luxury Coastal Vacations.

When should I buy travel insurance?

As soon as you book your trip. Buying early ensures maximum coverage if you need to cancel before you even hit the beach.

Where to Stay on the Gulf Coast?

Looking for an extra idea to make the most of your vacation on the Gulf Coast? Book your stay with Luxury Coastal Vacations. We offer the finest selection of luxury rentals on the Gulf Coast, spanning Alabama and Florida.

When you choose to stay in one of our homes or condos, you can expect a 5-star experience that you'll cherish forever. Browse through our options and discover what awaits you on the beautiful Gulf Coast.